Supreme Court grants homebuyers interim protection from recovery proceedings initiated by banks

The order was passed in an appeal against a Delhi High Court verdict which held that since the issue was purely contractual in nature, the case of the homebuyers cannot be entertained.

Supreme Court grants homebuyers interim protection from recovery proceedings initiated by banks

The Supreme Court on Tuesday granted interim protection to a group of homebuyers who sought deferment of payment of EMIs to banks till they are given possession of their allotted houses [Rohit Kumar v. Union of India and Others].

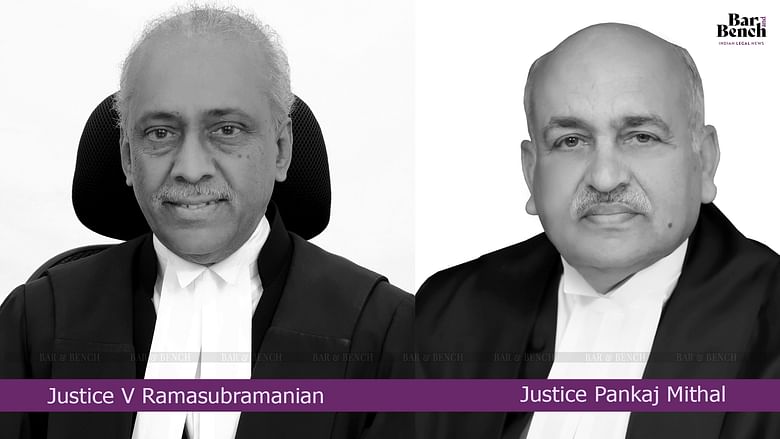

While issuing notice, a Division Bench of Justices V Ramasubramanian and Pankaj Mithal ordered that no coercive action should be taken by the banks against the homebuyers.

"Issue notice, returnable in four weeks. Since the petitioner has had the benefit of interim protection from 25.05.2022 till the date on which the impugned order was passed, the petitioner shall be entitled to the benefit of the same interim protection till the next date of hearing," the order said.

On November 1, 2012, the appellant-homebuyers had entered into a builder-buyer agreement with one Shubhkamna Buildtech Private Limited (builder). A tripartite agreement was also entered into by the homebuyers with the said builder and PNB Housing Finance Limited (finance company), which was in the nature of a subvention scheme.

The builder failed to comply with the agreement with the homebuyers, and had not delivered the possession of the said units within the stipulated time. The said builder also failed to carry out its liability of paying EMIs. Meanwhile, the finance company had initiated coercive legal action against the present homebuyers for the purpose of recovering the said EMIs on the loan facility.

Aggrieved by the same, the homebuyers moved a writ petition before the Delhi High Court seeking direction to the financial institutions not to charge the pre-EMIs or full EMIs from the homebuyers till the possession of the units as promised by the builder is not delivered to the homebuyers.

The homebuyers had also sought interim protection from the recovery proceedings initiated by the finance company. By its order dated May 25, 2022, the High Court had granted interim protection to the homebuyers till the final disposal of the petitions.

On March 14, 2023, the High Court while deciding the petitions held that though the petitions are maintainable, the same cannot be said to be entertainable on account of availability of effective alternative remedies available with the homebuyers.

“Since the interest of a large number of home buyers is involved in these cases, if they avail the alternative remedies, the same may be considered and decided expeditiously in accordance with the law,” the High Court had said.

The High Court was of the view that since the case was purely contractual in nature, the petitions cannot be entertained.

Challenging this order, the homebuyers have now approached the apex court.

Before the top court, the homebuyers have argued that pursuant to the decision of the High Court, the interim protection granted to them has been lifted. Therefore, the bank officials of the finance company have again started making repeated calls to the homebuyers for payment of EMIs, and have started visiting their residences.

Considering the same, the homebuyers have prayed the top court to grant them interim protection till the disposal of the present appeals, as was previously granted by the High Court.

Considering the circumstances narrated by the homebuyers, the top court granted interim protection to the homebuyers till the next date of hearing.

The matter will be heard after four weeks.

Advocate-on-Record Abhinay and Advocates Sakshi Jain, Pooran Chand Roy, LK Srivastava and Parul Khurana appeared for the homebuyers.